Optimizing Yard Operations: Insourcing vs. Outsourcing

WHITE PAPERLogistics Companies

Curious About Outsourcing

Visibility Suffers with

Insource Yard Operations

Electric Vehicles Offer

Sustainability Boost, Cost Savings

There are a lot of moving pieces in the logistics industry. It can be difficult for leaders and decision-makers to keep their eyes on every aspect of the business, especially when there is a lack of data, often allowing behind-the-scenes operations, like yard management, to fall through the cracks.

Operational inefficiencies are commonplace in yards, but that does not mean they should be accepted as business costs. The spending – in dollars and minutes – associated with these inefficiencies is too high to ignore. Fortunately, shippers and brokers have options for tackling these issues.

FreightWaves partnered with Lazer Logistics to better understand how shippers and brokers manage their yard operations. The duo surveyed industry leaders about in-house versus outsourcing operations, yard visibility, and the introduction of electric vehicles.

A plurality of respondents (43%) identified as brokers or third-party logistics providers. When taken together, about the same amount of respondents identified as shippers or manufacturers. This split increases the accuracy and actionability of the results.

FreightWaves also asked survey respondents about the types of goods their companies ship or broker. Manufacturing/industrial was the most common sector among respondents, accounting for 27% of the total. Food and beverage (18%) and retail (14%) were the second and third most popular sectors.

Logistics Companies

Curious About Outsourcing

It is common for companies to enlist third-party partners to manage everything from procurement to payment. By outsourcing some of their most time-consuming day-to-day tasks, shippers and brokers can free up their employees for more focused work elsewhere while also ensuring their companies are running at the highest levels possible due, in part, to the help of third-party experts.

This same mentality has yet to be applied to yard operations, often leading to rampant inefficiencies and operational frustrations.

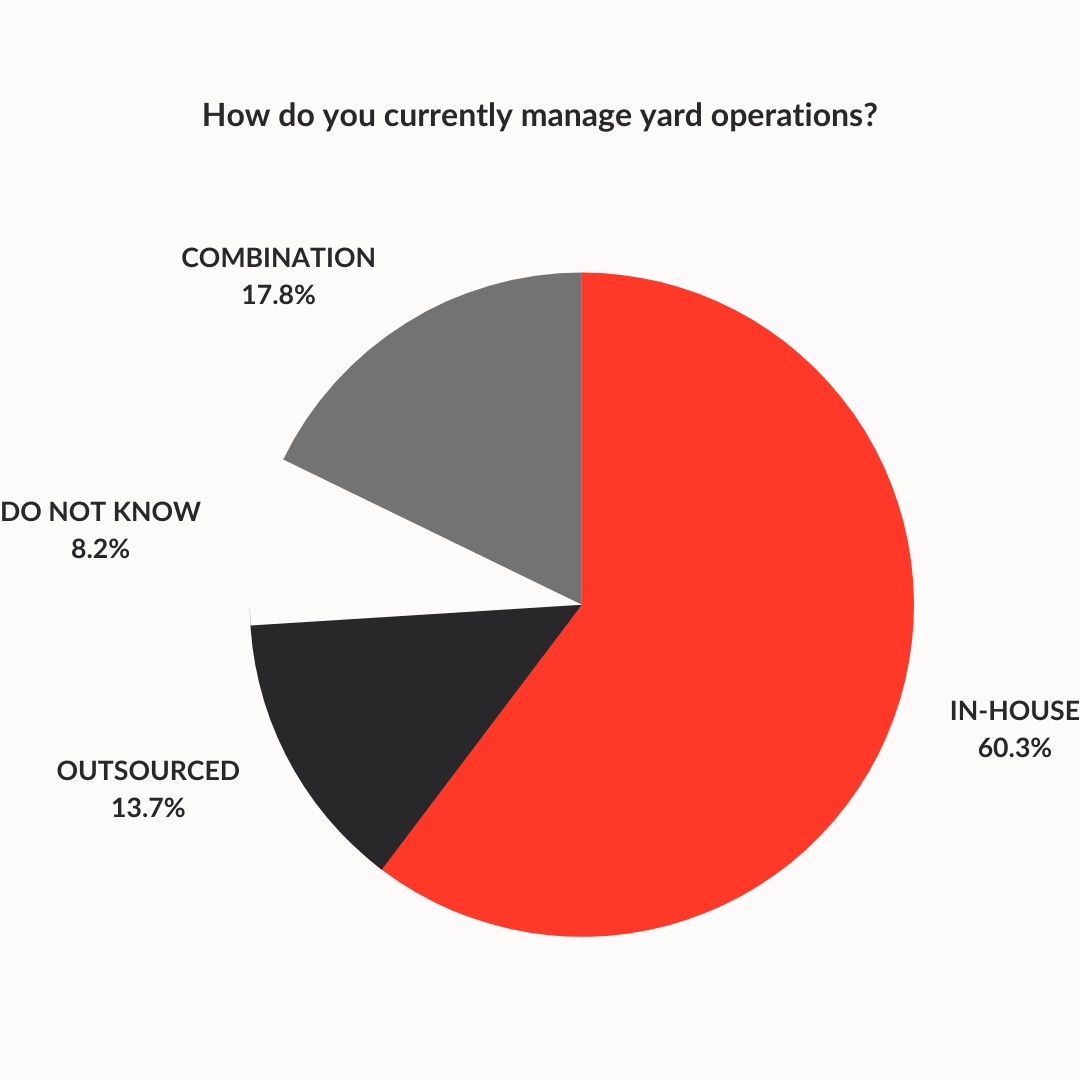

Most respondents (60%) manage yard operations entirely in-house. Among the rest, shippers and brokers are more likely to be blending in-house and outsourced management (18%) than they are to be fully committed to outsourced management (14%).

This tendency toward in-house management does not indicate that companies are not interested in outsourcing. It often illustrates a need for more time and resources to improve yard operations and a lack of knowledge about options.

Companies often need more time and money to implement new solutions. While making improvements to any part of the business requires some upfront investment, weighing implementation costs against potential long-term gains is essential. When considering yard management specifically, the cost savings associated with improved operational efficiency more than makeup for any upfront fees in a relatively short time.

Shippers and brokers are beginning to make these considerations and becoming increasingly curious about their outsourcing options. A significant minority of survey respondents (23%) have either already outsourced their yard operations or are in the process of doing so. These companies are leading the pack.

The survey data indicates a largely untapped market ready to try something new. Lazer Logistics has been offering yard management solutions since 1996, and the company continues to innovate as technology grows. With hundreds of locations across North America and technologies ranging from electric vehicles to next-gen vehicle data management systems, Lazer Logistics is poised to offer these curious companies the opportunity to thrive.

Right now, low outsourcing numbers in this area reinforce a lack of visibility, which drives the challenges and inefficiencies shippers and brokers face daily. Optimization will become familiar as companies link with forward-thinking, action-oriented yard management partners.

Visibility Suffers with

Insource Yard Operations

A lack of visibility is one of the most significant challenges shippers and brokers face when attempting to manage yard operations in-house. These companies need more time and technologies to routinely review, optimize, and safeguard their yards. This leads to opaque processes that make it challenging to pinpoint inefficiencies, much less solve for them. Shippers and brokers have yet to have a clear consensus about how frequently yard operations review sessions should occur. The most common answer was quarterly, but this option only pulled 16% of the vote.

About 12% conduct review sessions annually, and another 12% see “less frequently than annually.” Nearly 10% of respondents said they never hold review sessions. This suggests that about 35% of the broker and shipper market is going at least 12 months – and often longer – between optimization and review sessions.

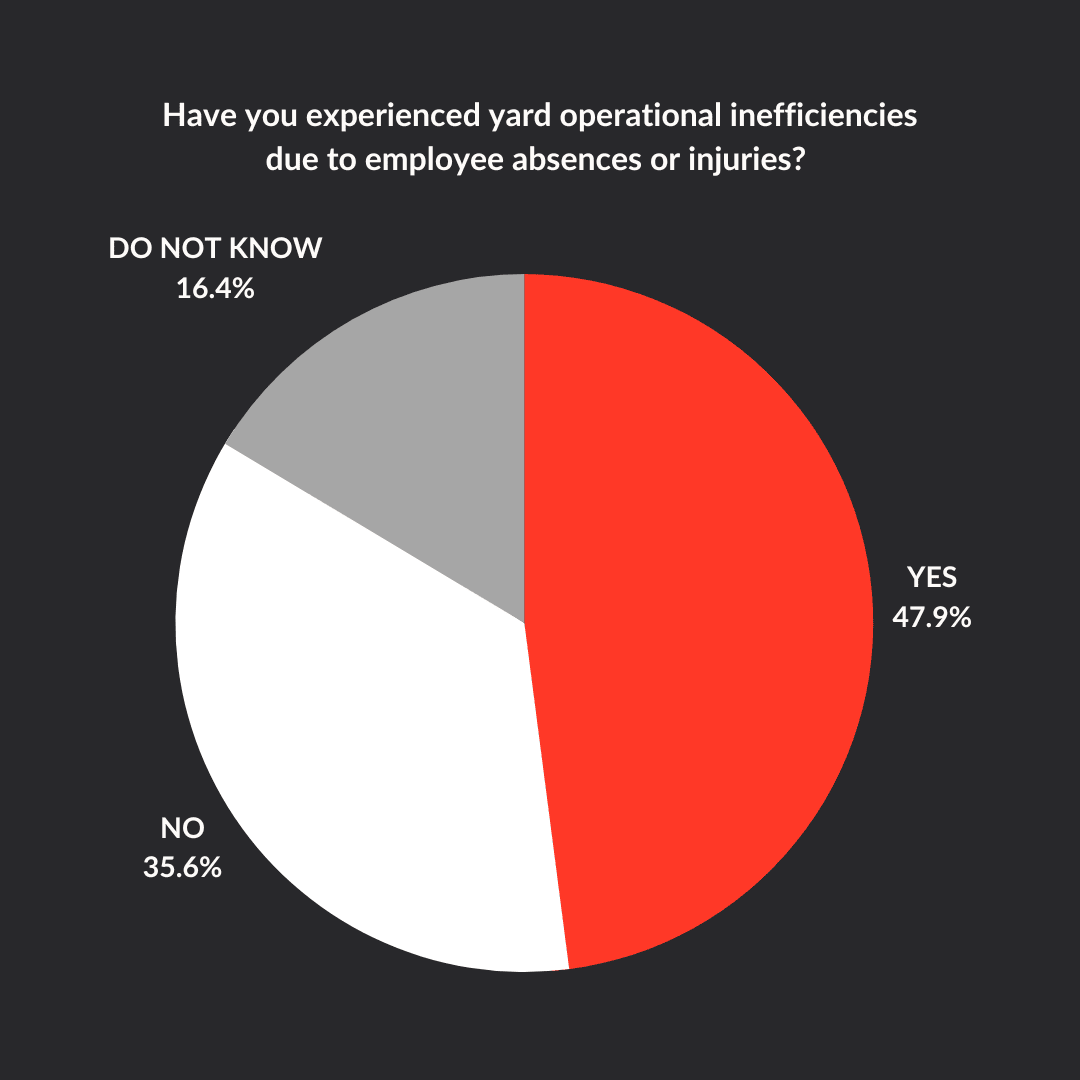

Nearly half of shippers and brokers have experienced operational inefficiencies due to employee absences or injuries, which suggests these inefficiencies are commonplace. In light of previous questions’ results, respondents may feel that these inefficiencies are simply a part of operating a yard.

In light of previous questions’ results, respondents may feel these inefficiencies are simply a part of operating a yard.

When high levels of absenteeism and frequent injuries are combined with a strong tendency toward in-house yard management, it becomes clear that most companies do not have the internal resources, knowledge, and capacity to operate a yard safely and efficiently. The most efficient companies do not accept these inefficiencies, instead implementing strategies and forming partnerships to overcome them.

Electric Vehicles Offer

Sustainability, Cost Savings

Electric vehicles have been a hot topic across the logistics industry. While battery life and charging infrastructure concerns dominate conversations about their suitability for over-the-road work, eco-conscious powerhouses are ideal for yard operations.

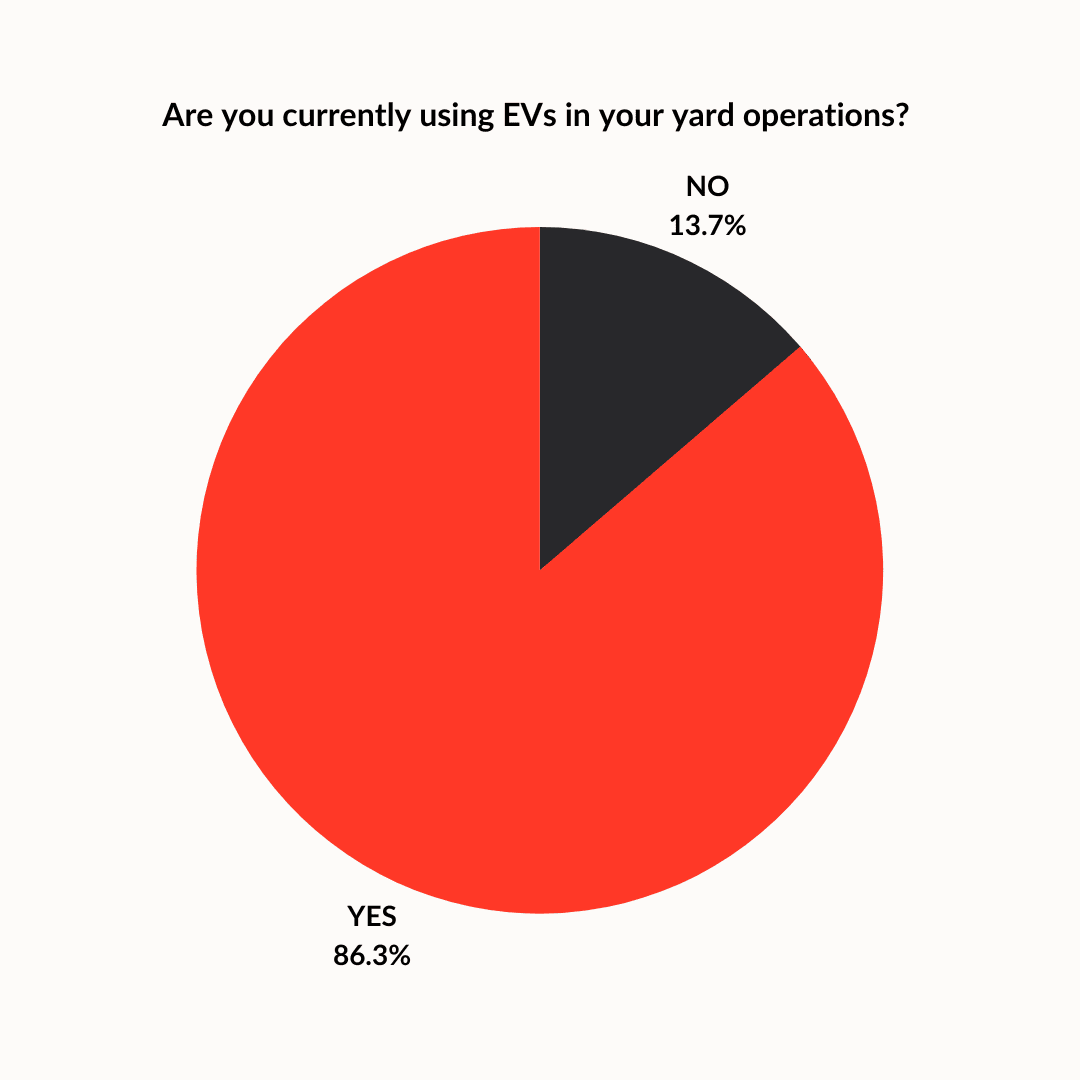

While few respondents (14%) currently use electric vehicles in their yards, this number is nearly certain to go up in the near-term future as the industry’s focus on sustainability grows, government regulations expand, and EV options become more expansive.

The respondents who have already embraced the fuel efficiencies of EVs are well-positioned to move ahead of the competition, mitigate costly regulatory fines (e.g., the WAIRE Act), and attract and retain drivers.

The respondents who have deployed electric vehicles noted that noise and air pollution reduction were the most common benefits, pointing to EVs’ ability to create a cleaner and more pleasant work environment.

While none of the survey respondents cited improved safety or employee morale as immediately recognizable, these benefits tend to surface once the new vehicles have operated for a few weeks or months.

Overall, yard operations are among the best use cases for class 8 electric vehicles. They provide substantial greenhouse gas emission reductions, improved community air quality, significant fuel cost savings, and a better operating experience for everyone involved.

Lazer Logistics has extensive experience operating electric vehicles across the United States and continues to expand its battery-electric yard spotter fleet.

Lazer Logistics has been at the forefront of yard management transformations, having worked directly with shippers, brokers, production facilities, distribution centers, warehouses, and e-commerce centers since 1996.

Initially, the industry trends were focused primarily on yard spotting (shunting, yard jockeying, or yard dogging). As Lazer’s customers began to see the efficiencies and gain insight into their yard operations, they began to place as much emphasis on the outside of their operations as they had placed on the inside.

Shippers and brokers need help bringing visibility and operational efficiencies to their yard management.

Despite an industry-wide willingness to embrace outsourcing other day-to-day functions inside the four walls of the operations centers, most companies have yet to take the same approach to their outside yard operations.

Shippers and brokers are slowly waking up to this reality. Many of these companies are now actively researching outsourcing options to help them gain visibility and optimize their yard operations to save time, money, and talent.

Those who have already switched to outsourcing their yard operations were amazed by how much time, resources, and effort it took to manage their yard operations and how inefficient they were. They now benefit from data and metrics to set KPIs and showcase the value of their yard operations.

Since COVID, Lazer has seen an exponential appetite for more efficiencies in other areas of their client’s yard operations, including yard management systems, shuttling, gate operations, trailer utilization, and, more recently, electric vehicles.

FreightWaves believes demand for yard management services and the ability to gain visibility into the yard will only increase, especially as the companies that have already embraced outsourcing begin to realize efficiencies and widen the gap with their peers.